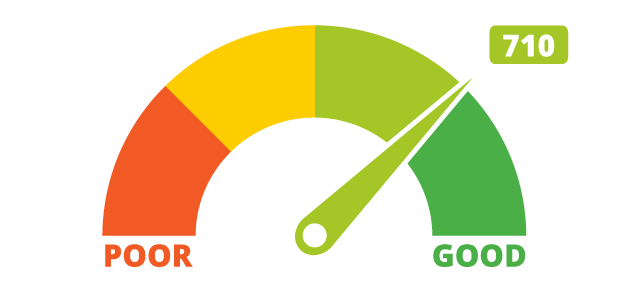

Many Americans struggle with their credit score. Late payments, a high debt-to-income ratio and defaults can lower a credit score for years.

A good credit score is vital for more than just obtaining credit. It can affect how much you pay on a mortgage and auto loan, for example, and a poor credit score can even increase your auto insurance premiums.

Fortunately, there are ways to increase your credit score even if you aren’t awash in cash. Below are three tips for improving your credit score.

Monitor your score

Many of us don’t bother to check our credit scores periodically. Fortunately, many credit cards and banks are now offering informal credit scores that are easily available online. In addition, you are entitled to one free credit report per year from each of the three big credit bureaus: Equifax, Experian and TransUnion.

- You should also monitor your score for changes. Identity theft and inaccurate reporting are real problems. Monitor your score for sudden, unidentifiable changes, and contest inaccuracies.

- You may wish to freeze your credit report if you are not planning on taking out loans in the near future. You can always unfreeze it if you need to purchase a car or home later.

Get more credit

This may seem counterintuitive, but having a low utilization rate is one of the driving factors behind a good credit score. This means, essentially, that you have access to credit which you haven’t used. If you have a credit card with a $10,000 limit, for example, never have more than a $1,000 outstanding balance. Having credit available, when used responsibly, can greatly increase your score.

Of course, this method only works if you are able to avoid using the available credit.

Focus on paying down active credit

People struggling financially often pay defaulted loans first. This is a mistake. Pay down active accounts first. Credit on which you have defaulted isn’t going anywhere, unless you declare bankruptcy. Focus your money on getting down active and low-balance accounts first. Another default or more debt is going to make your credit score worse.

Consider bankruptcy

If you simply don’t have enough money to pay essential bills without using credit, bankruptcy may ultimately improve your credit in the long run. While bankruptcy hurts your credit score immediately, it is a way to get out from a vicious cycle of debt and high interest rates.

With proper planning, credit scores can show steady improvement. It may not take as long as you think to rebuild credit and ultimately be able to afford a home, car payment and other items that come with good credit.